AITECH Tokenomics

A brief overview of the AITECH tokenomics

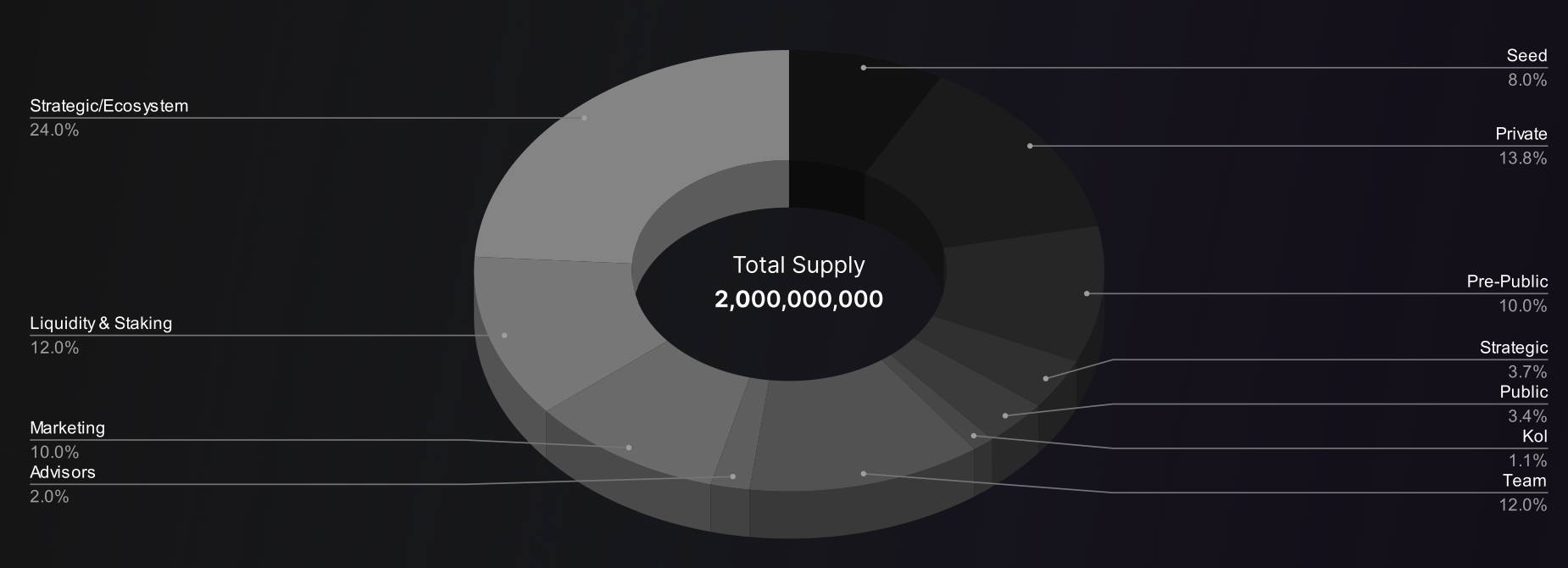

ALLOCATION DISTRIBUTION

The allocation distribution plays a pivotal role in the monetary policies of a token. It is responsible for defining the entire process of creating, emitting, and distributing new tokens among different pools or shareholders.

VESTING RELEASE SCHEDULE

Another crucial monetary policy that significantly influences the rate, accelerations, and velocity of new token introduction into the system is the vesting release schedule. This fundamental process holds immense importance in the overall tokenomics as it provides us with a wealth of data to analyze and interpret.

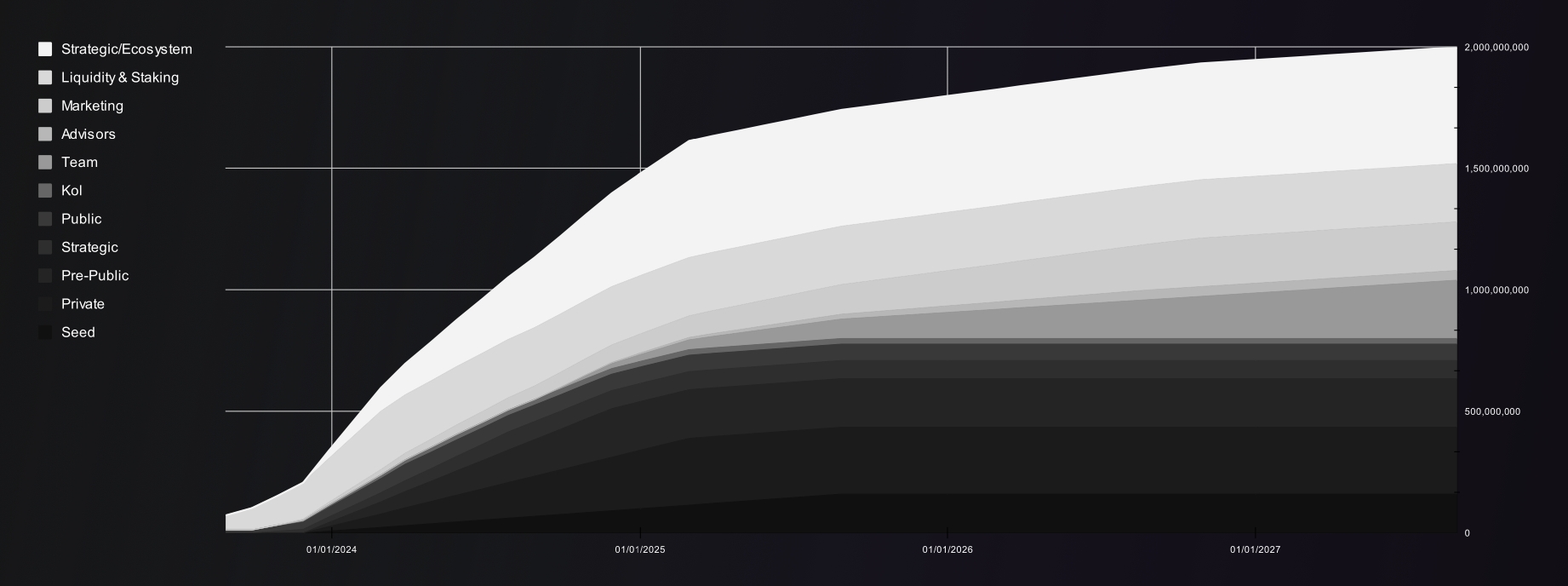

SUPPLY METRICS

The below representation displays how the token supply will develop for the next 4 years

Note: The team tokens unlocking schedule has been delayed to align the incentives of the team and put the community first. The tokens will begin unlocking linearly from the 28th of March 2025 and will vest over a 36-month period.

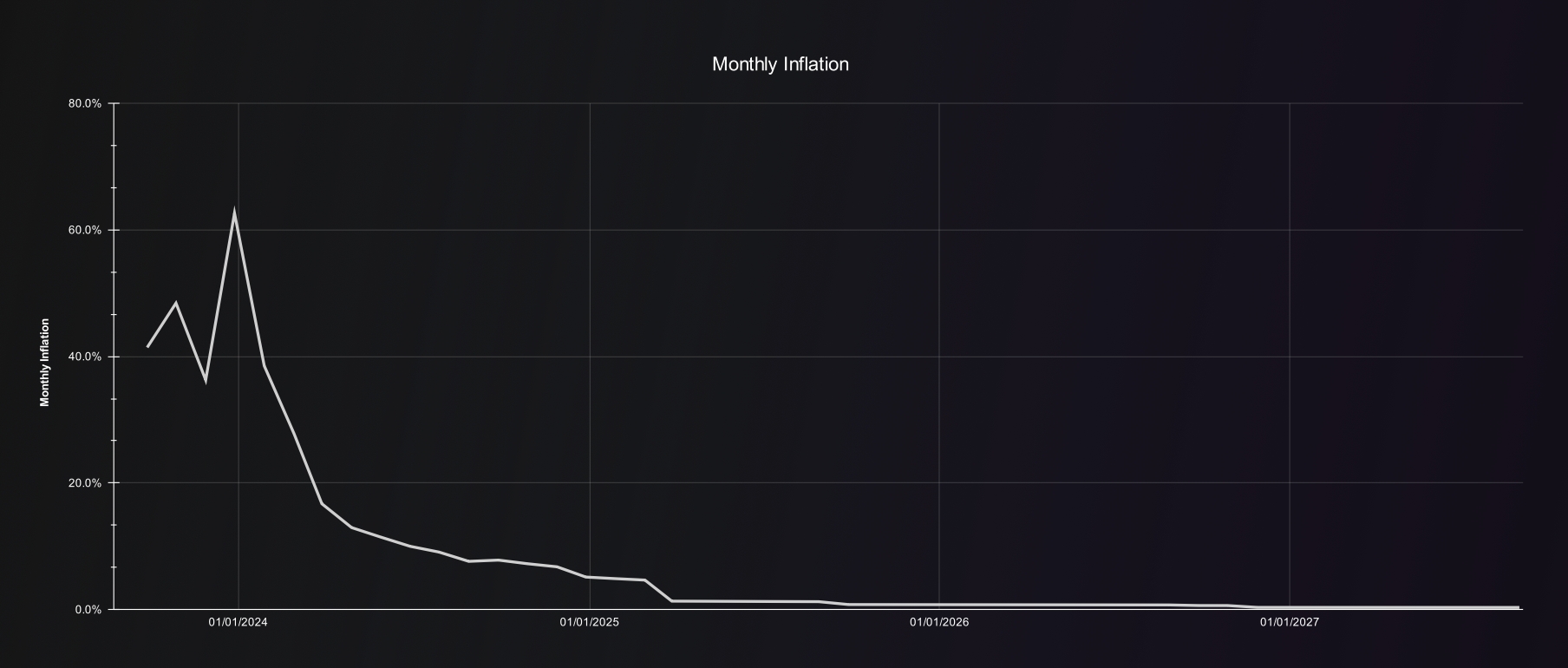

CIRCULATING SUPPLY INFLATION

The below representation displays how the token circulating supply will develop for the next 4 years

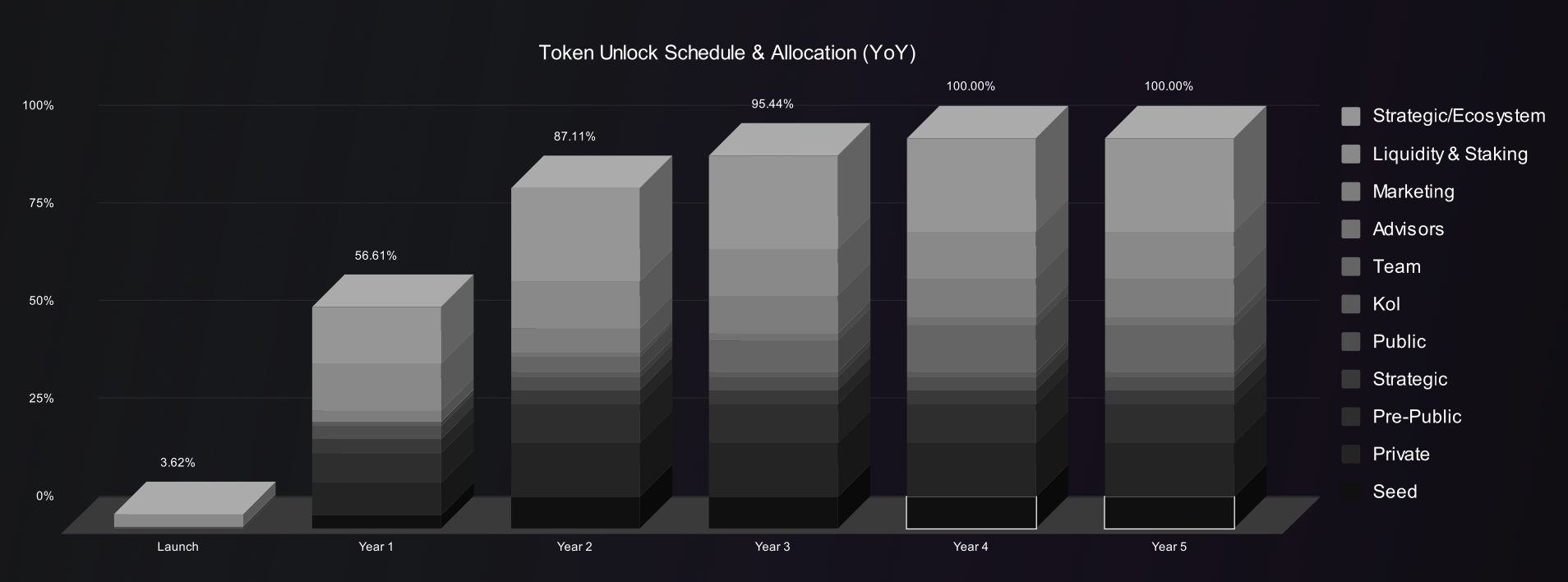

CUMULATIVE INFLATION

This is how the cumulative token inflation will develop for the next 5 years.

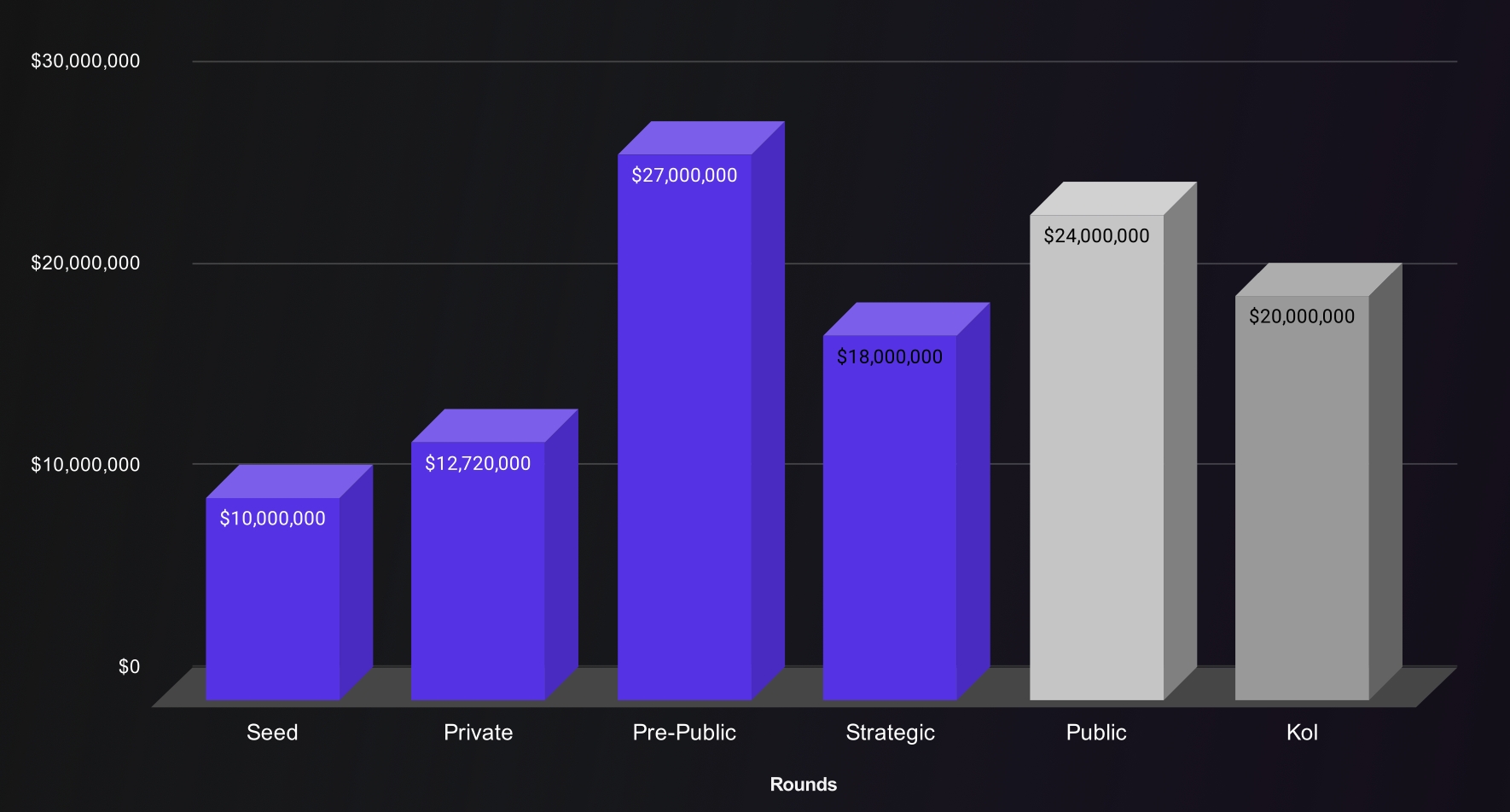

Fully Diluted Valuation (Per Round)

Deflationary Economy

AITECH operates on a robust deflationary model designed to enhance scarcity, drive demand, and reinforce long-term value appreciation. Through strategic token burns, a portion of the supply is permanently removed, ensuring a continuously shrinking circulating supply. This mechanism, combined with staking rewards, incentivizes participation while strengthening the token’s utility within the Compute and AI Marketplace. By aligning economic incentives with ecosystem growth, $AITECH fosters a sustainable and appreciating asset for its holders.

Read more on the burn program:

Perpetual Burn Program